i. Adjustable-level mortgage loan with low cost for 3 several years. Think an adjustable-charge home loan has an First discounted rate of five % that is mounted for the first a few yrs, measured from the first working day of the 1st entire calendar thirty day period pursuing consummation, and then the rate will modify each year based on a specified index additionally a margin of three %. The index value in result at consummation is 4.five per cent. The loan arrangement offers for an once-a-year curiosity rate adjustment cap of 2 percent, along with a life time greatest fascination price of 12 %. The initial charge adjustment occurs on the thanks date of the 36th month-to-month payment; the speed can change to not more than seven p.c (five p.c initial discounted amount as well as 2 percent once-a-year curiosity charge adjustment cap).

, the thoroughly indexed fee), the creditor must not give any outcome to that fee cap when deciding the fully indexed level. That is, a creditor should ascertain the fully indexed level with out taking into consideration any periodic desire level adjustment cap that will limit how speedily the thoroughly indexed amount may be arrived at at any time through the loan term under the terms in the lawful obligation. For example, suppose an adjustable-fee property finance loan has an initial fastened charge of five p.c for the 1st a few many years of your loan, after which the speed will alter annually to some specified index furthermore a margin of 3 %.

Data Far more details At Bankrate we strive that may help you make smarter economic selections. Whilst we adhere to stringent editorial integrity , this post may perhaps consist of references to solutions from our associates. This is an explanation for a way we earn a living .

You have got dollars thoughts. Bankrate has answers. Our experts have been helping you grasp your money for more than four decades. We constantly try to provide people Along with the skilled suggestions and applications necessary to realize success in the course of everyday living’s money journey. Bankrate follows a strict editorial plan, so that you can have faith in that our articles is truthful and correct. Our award-successful editors and reporters create straightforward and accurate content material that can assist you make the best economical decisions. The articles designed by our editorial team is goal, here factual, instead of affected by our advertisers. We’re clear regarding how we can provide excellent written content, competitive premiums, and helpful applications to you by outlining how we earn cash.

An additional online lender, LightStream has a number of the ideal charges during the marketplace. The lender is very best suited to All those with fantastic credit rating and robust financials.

, the accrued but unpaid desire is extra into the principal stability). Therefore, assuming that The patron makes the bare minimum monthly payments for as long as possible Which the maximum fascination price of 10.5 p.c is reached at the main price adjustment (

(twelve) Simultaneous loan implies One more coated transaction or residence equity line of credit history issue to § 1026.forty that could be secured by a similar dwelling and manufactured to exactly the same buyer at or prior to consummation from the included transaction or, if to become built following consummation, will deal with closing charges of the main coated transaction.

You may also develop and print a loan amortization routine to view how your month-to-month payment pays-from the loan principal plus desire in excess of the program of your loan.

For any phase-price home finance loan, nevertheless, the speed that has to be employed is the very best price that should apply over the 1st five years following consummation. As an example, if the speed for the 1st two many years after the date on which the 1st regular periodic payment will be because of is four percent, the speed for the subsequent two decades is five percent, and the rate for the next two decades is 6 per cent, the rate that needs to be employed is six p.c.

Own loan files generally include proof of identity, employer and revenue verification files — similar to a fork out stub, and something that proves your handle.

Nevertheless, a hard inquiry might be put with Clarity after you post a complete software, which may possibly have an impact on your overall credit history profile using this type of bureau. For customers that are not responding to an Lively business give of credit rating, a hard inquiry will not be placed on your TransUnion or FactorTrust credit report till you are permitted for and accept a loan.

These loans give a number of the cheapest fees accessible, and credit score checks aren’t expected. Desire on a 401(k) loan ordinarily equals the primary fee — the benchmark that's utilized by banks to set prices on buyer loan products and solutions — in addition one or two proportion details. Also, the curiosity you fork out goes back again on your retirement account.

2. Index or formula value at consummation. The value at consummation from the index or formulation needn't be used In the event the contract offers for the delay from the implementation of variations within an index price or formula.

(A) The utmost fascination level that will utilize in the course of the initially five years following the date on which the main typical periodic payment will probably be owing; and

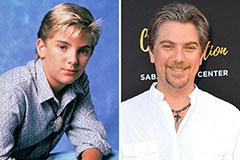

Jeremy Miller Then & Now!

Jeremy Miller Then & Now! Keshia Knight Pulliam Then & Now!

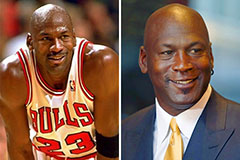

Keshia Knight Pulliam Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! Batista Then & Now!

Batista Then & Now! Christy Canyon Then & Now!

Christy Canyon Then & Now!